Banks on Wall Street do business on exchanges, but in reality they hate them. The big banks despise the existence of places like the New York Stock Exchange ($NYX), and Chicago Mercantile Exchange ($CME) because of the transparency they bring to the market place. They use groups like the Futures Industry Association (FIA) to lobby against them some of the time. I have seen them fight the path to transparency and support the fraud that takes place in Forex bucket shops in order to protect some of the business practices they have made standard on the street.

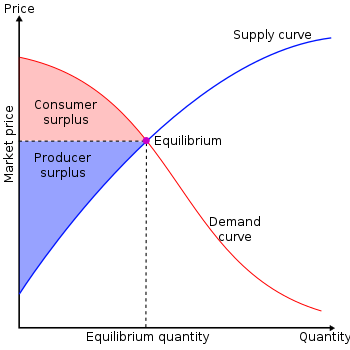

After all, the battle in a lot of trading is who is going to own the consumer surplus. Consumer surplus is the amount of profit in the market that they can eek from the bid/ask spread. Wider spreads don’t necessarily mean more profit by the way.

It’s becoming more clear that MF Global ripped off their own customers. Yesterday’s testimony revealed that they shifted $175 Million dollars of customer money to Europe. They got caught with their pants down. No doubt, lawyers are scrambling today.

However, it’s more than that. That piece of testimony shows the true value of an exchange, and why I am so against dark pools, internalization and payment for order flow. Properly regulated organized markets and structured clearing and settlement bring price transparency to the market. They bring accountability. A lot of the nefarious crap that goes on wouldn’t with correct structure and regulation.

If you are too young to remember, or old enough to not want to remember, in 1987 we had the great October crash. Congress and the oracles on the street wanted to point the finger at the S&P Futures pit ($ES_F)as the cause of the great tumble. The futures contract started in 1982. Clear logic would point to its existence as the reason for the crash since we never had anything like that before. (Of course, we had options since 1972, but the big boys controlled those)

When asked if they could produce records of trades, clearing and where the money came and went for, none of the big banks could do it after the fact. They couldn’t piece together the trades because they hadn’t marked them yet. On the futures side, they could produce a trade register, showing all accounts and the pays and collects by account number….the next day. MF Global might not have known exactly where the money is a couple of weeks after the fact, but they have more than an inkling of how it was transferred out. Certainly, by now they know but they aren’t saying.

That brings us back to transparency and markets. Currently, the SEC side of the marketplace is not transparent. The bulk of the volume is not traded at the NYSE or NASDAQ ($NDAQ). Trading happens behind closed doors. It’s not readily reported, and no one knows who is trading what with whom. Price and volume information is crucial to markets. Without it, the mechanism begins to break down. People lose confidence and leave. Volatility ensues. This should sound familiar.

When trading happens behind the curtain, the banks rip off a few pennies from each of their customers. If you think your order is getting a fair shake when some outfit pays to trade against it, think again. You might be getting a cheaper commission by a dollar, but over the long haul the big boys are making more off the pennies than the dollar you save.

We have had several events over the past few years that have pointed to a break down in the current market structure. The financial crisis, the flash crash, now this MF Global fraud. Writing new regulations on top of the poor ones we have isn’t going to fix anything. The slate needs to be wiped clean. With electronic marketplaces, we can level the playing field and make it even more competitive.

It’s truly a shame the fraud that Jon Corzine and his firm placed upon the market in order to grab a bunch of “free money”. But, it’s really truly shameful how Jon Corzine and the big banks use crony capitalism to the best of their ability to undermine markets and rig the game in their favor.

That’s why the big banks are against the exchanges and the market transparency and accountability they bring to the table. Remember that.

follow me on twitter

Thanks for the link The Big Picture.

thanks for the link Fortune

The post Why Banks Hate Exchanges appeared first on Points and Figures.