Warren Buffett has been advocating that we raise taxes in the US. Why would a rich guy say that? Believe me, it’s not because Buffett is some altruistic person brimming with patriotism. He may be that in other endeavors, but the reason he wants a tax hike is pure business and in his own self interest.

Buffett doesn’t pay taxes like you and I. He pays capital gains and that is it. Net net, he pays less than 15% because of all the write offs against his income. You will notice that Berkshire ($BRK-A, $BRK-B) doesn’t pay a dividend. Buffett says they will talk about that next year-which is like talking about a lot of things next year. As we have witnessed time and time again, talk is cheap.

No, the real reason Buffett wants massive tax increases is because it’s going to drop the acquisition costs for businesses. Buffett doesn’t build and create businesses. His strategy is to swoop in and buy undervalued ones and wait, or change their operations and make them efficient so they throw off streams of cash. A vulture capitalist in the strictest sense.

He is admirable, because he is a highly disciplined investor. It takes a lot of balls to wait sometimes and miss opportunities that others pounce on. Remember, he did that with internet companies in the 1990′s. He said it was because he didn’t understand them, but really it’s because they were overvalued and by his book he knew it.

Professor John Cochrane illustrates the point in his latest blogpost.

Mr. Buffett wants you to think his investments are arbitrage opportunities, and a 2.5% arbitrage is as attractive as a 5% arbitrage. That’s false. Investments involve bearing risk, and taxes make those investments directly worse.

Now, the effect of taxes here is subtle. Yes, a 50% tax rate cuts a 5% expected return down to 2.5%. But it also cuts volatility too. Isn’t this just like deleveraging? Answer: no, because unless you’re investing in green energy boodoggles only available to Administration cronies, the government takes your profits, but does not reimburse your losses.

If the investment makes 10%, you get 5%. If it makes 5%, you get 2.5%. But if it loses 10%, you lose 10%. It’s a strictly worse investment when taxed. (Yes, you might be able to sell the losses if the IRS doesn’t notice what you’re up to… but now you know why Buffett is a “master of tax avoidance.”)

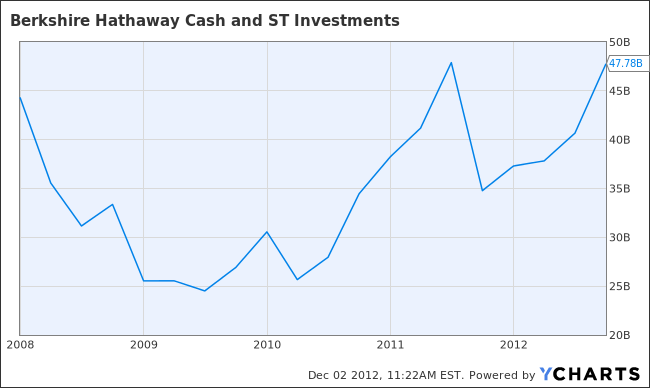

Buffett is not any different from any other person. He is advocating a change in policy because it is in the best interest of his company to have that change. If he gets his way, company valuations will drop. Berkshire is sitting on a huge pile of cash that in the current environment, they find almost impossible to employ. That’s why he said wait ’till next year on dividends. If tax policy doesn’t change, Buffett will be under incredible pressure to send cash to investors because he can’t earn a high enough rate of return on it.

BRK.A Cash and ST Investments data by YCharts

Buffett’s competitors don’t have as much cash as he has. Federal Reserve policy has dropped the value of the US dollar, and has inflated the valuations of companies. Raising taxes, especially estate and capital gains taxes would have a contrary effect. Further, his competition will lose cash and have less to invest making it easier for him to compete.

The Oracle of Omaha has a public personna of the old folksy Grandpa. In reality, he is a cunning, competitive capitalist just like any other investor. He just has been so successful that he has the cash and connections to play a different brand of game than anyone else.

thanks for the link Doug Ross.

Related articles

The post Why Vulture Capitalist Warren Buffett is in Favor Of High Tax Rates appeared first on Points and Figures.